The shoemaker’s children go barefoot, you say? Absolutely not. We have been helping clients with financial analyses for a long time, and we carry out the same meticulous work on our own business.

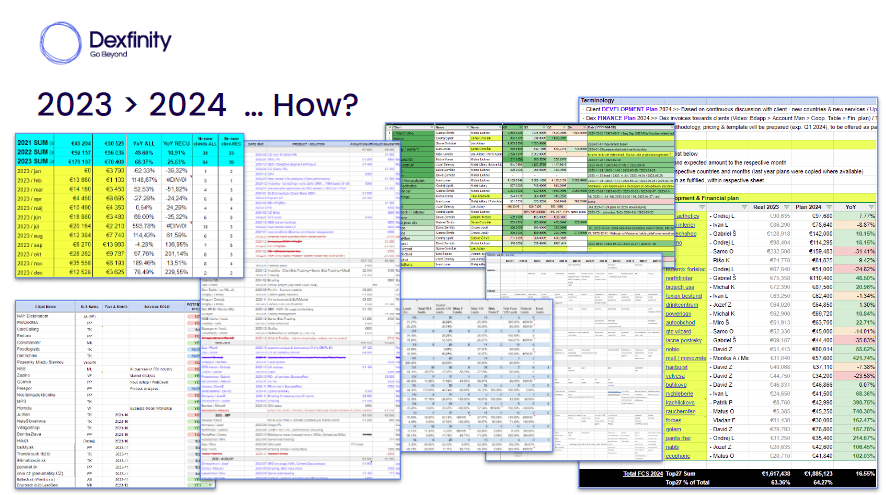

In 2024, Dexfinity plans to achieve a revenue growth of 15%. How did we arrive at this number?

How to realistically plan double-digit growth

Annually, we generate a turnover of 180 million for our clients, and we reinvest more than 40 million in credits. In order to be able to grow together with our clients and deliver perfect services, we need to be in control of our own finances.

The financial plan for Dexfinity was created as a result of 15 variables that we track on a daily or monthly basis. These all relate to internal and external factors that affect sales growth. During planning, we used data from previous years and took into account forecasts for the coming months. Which data did we use?

External factors:

- The overall progress of the e-commerce sector: In the Czech Republic and Slovakia, in 2023 e-commerce decreased by an average of 4 to 6% year-on-year, depending on the segment. At the same time, we monitor the Share of Search, which allows us to measure the size of the market and our market share.

- Year-on-year inflation: Purchasing power decreases with inflation, and if our customers’ customers have deep pockets, we, too, have a problem.

- Growth in interest rates: Interest rates have increased almost fourfold and the consumer’s wallet has felt this impact particularly hard.

- Google trends: They represent exclusive data that is available for our use and that of our clients. We see the development of demand from the point of view of search, display and interest in ads and their cost over the previous years.

- Client departure: The goal for 2024 is development through portfolio enrichment such as AI creatives, server-side tracking, business consulting and achieving further business growth. We use metrics to evaluate the churn rate, i.e. the percentage of clients leaving (ideally less than 5%).

- New clients: Attracting relevant clients in order to maintain the ratio of acquired vs. unacquired clients at the same level as last year, 1:1. We regularly monitor:

- Revenue for one-off services

- Revenue for regularly recurring services

- Annual value of the client (AnOV)

- Up- & cross-sell: Business growth support of existing clients, export and expansion to new markets. We are already present in 32 countries across the world. Similarly to what we do with new clients, when it comes to the development of existing clients, we also analyse:

- Revenue for one-off services

- Revenue for regularly recurring services

- The approximate value of an average order

- Marketing activities: This includes all events, conferences, content creation for further education, web enhancement, performance campaigns, social networks, lead generation and email marketing. We spend 7% of the turnover of the whole company on marketing. The parameters we monitor include:

- Price per lead

- Number of “yes/maybe” leads

- Soft metrics, such as Share of Search etc.

We are very pleased that at Dexfinity, it has never been the case that large clients bring in the vast majority of revenue. On the contrary, 60% of our clients generate 80% of sales. We ensure that we pay equal attention to each of them and we also analyse:

- On-site visits (number of personal visits to the client)

- The Top27 client program (number of personal meetings of our most senior people with the largest clients)

- RedButton (how often and with how much success we are able to prevent client departure)

Every activity associated with the client counts

By tracking these variables, we generate an overview of all the activities that contribute to Dexfinity’s growth. At the same time, in case of any declines, we are able to evaluate exactly where and what changes occurred that led to such situations.

We are not governed by any pareto principles. In finance, you cannot monitor only 20% of the parameters and hope for a bright future. Finances need 100% control and attention.

What makes it so magical?

Actually, nothing. We visit clients, inform them about news and innovations, address those who have left, try alternative approaches, measure success, enrich one-off services with recurring ones, improve processes, and implement QA of our work. We did not invent those 15 parametres.

The activities we do are not new or exceptional. But we do them meticulously, with respect, and regularly. We also measure and evaluate them. Therein lies the secret of a perfect financial plan.

Everything starts with strategy

Having said all that, it is not enough to simply choose some numbers. If you track 5 parameters instead of 15, you will get a different result.

Simply put, financial analysis is just plain honest work with numbers that may not be sexy, but it delivers immediate results.

New markets, new opportunities

To complement our international strategy, we plan to actively address new markets. Turnover targets (abroad versus Slovakia) stand at a ratio of 1:1.

In the short term, we will focus heavily on the Czech Republic. As for the marketing budget itself, we allocated Lead Gen costs at a ratio of 1:3 in favour of the new country.

Three development scenarios

Based on all the parametres, what did the forecast itself look like? We turned all the variables into numbers and graphs and came up with three scenarios for Dexfinity in 2024:

- optimistic if all predictions come true,

- realistic if we maintain the existing growth, but do not improve the set metrics (for example, increase cross-selling by 12%),

- pessimistic if we deteriorate in any of the monitored metrics and at the same time do not improve in the areas we have set.

A realistic scenario represents a 15%+ revenue growth for 2024.

Without proper execution, the vision is just another empty word

This is how we analyse Dexfinity’s sales from past years and at the same time predict the financial plan for the following ones. We consider having finances under control as the basis of every business. And what we offer as business plan to our clients , we also apply to ourselves.

Why have we waited until April to write about our financial plan for 2024? Because it’s working out. The first quarter’s predictions were fulfilled to the letter, so we’ve decided to publish our plans and procedures.

Get inspired and get your finances under control. If you find that you’re struggling, we’re here to help.

DIRECT CONTACT DETAILS

Let's join forces.

Share your project with us and let’s discuss it’s potential.

Michal Lichner

Global BizDev, Sales, Marketing Consultant

+421 911 585 689

michal.lichner@dexfinity.com

Eva Cechovska

Sales & Export Consultant

+421 918 341 781

eva.cechovska@dexfinity.com

Pavol Adamcak

International Marketing Strategy Consultant, Founder

+421 918 435 105

pavol.adamcak@dexfinity.com

Select all the areas you are interested in.