When did Croatia join the eurozone?

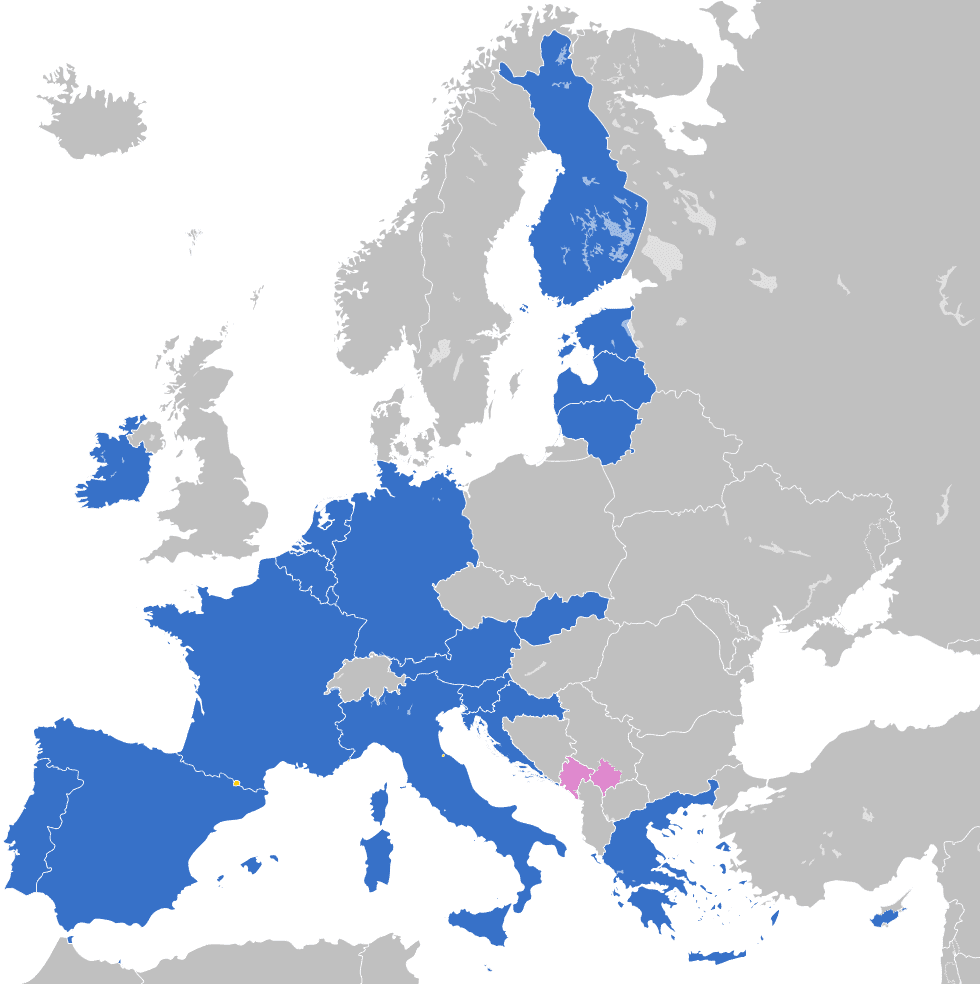

Croatia joined the eurozone on the 1st of January 2023 as its twentieth member. The accession process was a close call, as Croatia’s admission to the eurozone was approved only one day before the terms were changed.

According to the new terms, Croatia would no longer meet the pre-condition that states that inflation must not exceed the inflation rate of the three member states with the lowest inflation by more than 1.5%. However, this does not change the fact that Croatia has now been a member of the eurozone for almost a month and is converting to the euro with a conversion rate of 7.5345 Croatian kunas to 1 euro.

Is Croatia going to become more expensive?

The transition to the euro was most welcomed by entrepreneurs in the tourism sector. On the other hand, ordinary citizens were worried about price increases from the very beginning. Slovaks anticipated the same issue prior to joining the eurozone in 2009. The price hikes did come, but they did so before the euro was even introduced.

Currently, the situation is different, as the prices of goods, services and holidays are rising mainly due to inflation. Joining the eurozone has played only a minor role in the price increases. Moreover, given the current state of the economy, the average consumer will not be able to distinguish between artificial price increases and those that are really necessary.

Price increases are also controlled by the Ministry

Nevertheless, complaints about price increases are mounting. Residents blame high prices on the euro. Complaints from residents are investigated by the Ministry of Economic Affairs and other national authorities in light of the adopted Code of Business Ethics.

Dual price displays

If you are doing business in Croatia, you already utilise a dual price display in your online store, which is mandatory from 05/09/2022 to 31/12/2023.

For companies, dual price display presents a small technical complication in the CMS system, while for customers, it is an important way to verify prices. When they see the price in both the new and the original currency, they can immediately identify the price increase and check whether the conversion of kunas to euros is correct.

The two-week transition was handled with flying colours

For the first two weeks of 2023, Croatia operated within the so-called dual circulation period. This means that citizens could pay in both euros and kuna. As of the 14th of January 2023, they can only pay in euros. After the first two weeks, 90% of cash payments were made in euros.

Eurozone entry and e-commerce

Croatia’s foreign trade was strongly linked to eurozone countries even prior to the introduction of the euro. More than half of Croatia’s exports go to eurozone countries, while almost 60% of imports come from euro-paying countries.

The share of Slovak companies in Croatia is currently negligible, but removing barriers related to the exchange rate may attract more expanding Slovak online stores and foreign investors. The biggest change will be felt by holidaymakers, who will save on exchange bureau fees.

What are the benefits of Croatia’s entry into the eurozone for online stores?

In the short term, the removal of transaction costs carries the greatest benefit for the business. You will no longer have to deal with converting euros to kuna and vice versa. For example, in 2023, exchange rate fluctuations caused problems for Slovak e-shops doing business in Hungary.

The problems with exchange rate losses will also disappear, and if you export to Croatia or do business there, having the same currency will also make life easier for your accountant. It will also be easier to charge expenses for business trips, fuel, hotels and flights.

You will no longer need to maintain a separate account in a foreign currency.

For Croatian e-commerce, the euro means the arrival of new online stores and investors. Foreign trade is likely to increase.

With Croatia’s entry into the eurozone, Croatian banks and entities that have been profiting from currency exchange fees are likely to encounter problems. Some banks may lose up to a fifth of their profits, and smaller exchange bureaus will disappear altogether.

How to expand abroad?

Expansion is an opportunity for an online store to grow beyond the borders of Slovakia. It doesn’t matter whether a country is in the eurozone or not, everyone can succeed. We have helped businesses expand into Hungary, Romania and Germany, as well as the Czech Republic.

If you are unsure where to expand to with your specific product, or if you have a country of choice and are interested in local competition or demand, get in touch, and we’ll be happy to help.