Today we will show you an efficient way to clean up your online store finances. Find out which suppliers contribute the most to the running of your online store, which products are worth keeping in your selection and which ones you’d be wise to discard.

What are cover charges?

When it comes to managing finances, many Czech stores use cover charges in addition to a standard financial analysis. It is a shame that we don’t pay more attention to this approach here in Slovakia.

After all, cover charges can help businesses easily understand how each product or item that is sold contributes to covering fixed costs and achieving profit.

The end of the month is usually too late

In a standard financial analysis, you budget all costs for a specific unit of goods. If you sell 100 T-shirts and 50 sweatshirts, you have sold 150 products. With fixed costs of 1,500 euros, you attribute 10 euros to each product.

That’s how much every single product sold needs to contribute to the cash register in order for the business to function. You can also recalculate this according to the price of the goods (more expensive goods with a higher margin will carry a higher weighting).

The problem is that at the halfway point of the month, you have no idea how you’re doing. Do your sales to date cover your fixed costs? You will only find this out at the end of the month, when you know how many (and which) goods you’ve sold.

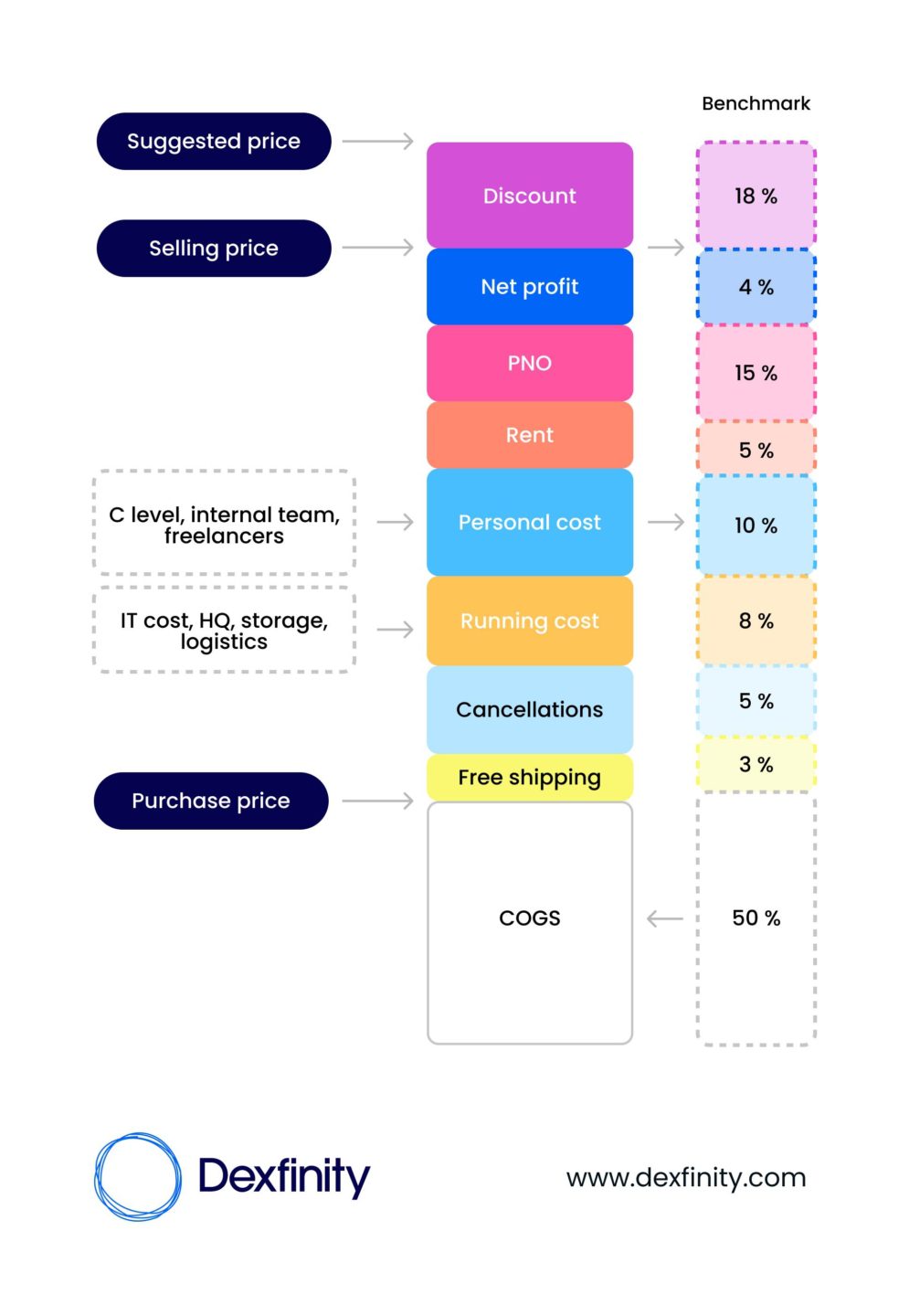

A standard approach to financial management, which gives you an overview of every single percent contributing to the running of the business.

Cover charges reveal the answers earlier

If you want to be able to determine whether or not you’ve earned enough money to cover the the programmer, the rent of the warehouse and the salary for the accountant at any point in the month, start using cover charges.

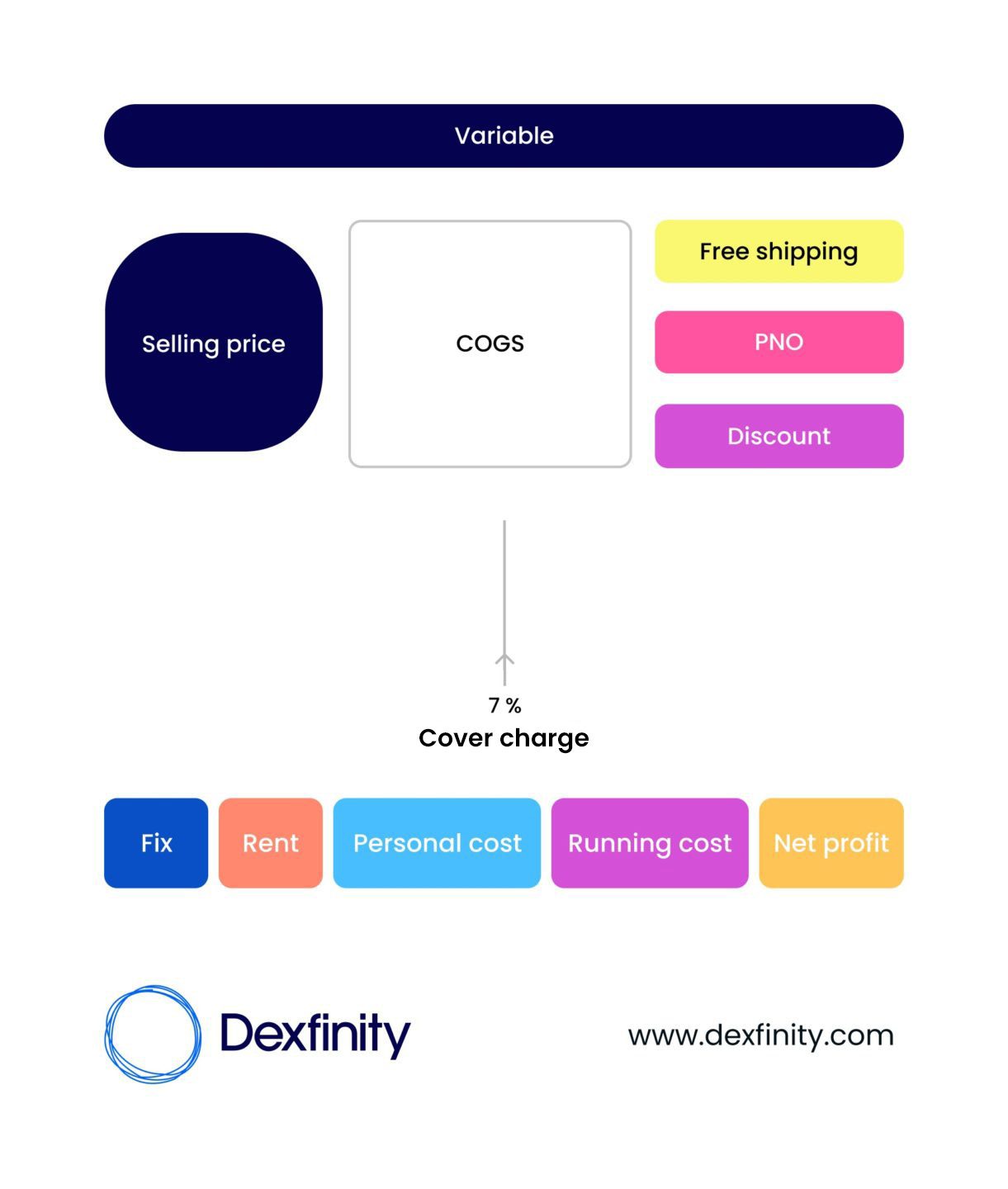

The cover charge is the difference between the selling price and the variable costs.

It’s really not complicated. Let’s explain it using a simple example with a T-shirt. First of all, you need to divide the costs into fixed and variable.

Looking at finances from a cover charge point of view divides costs into fixed and variable.

Selling price

This is the price you get from selling products. If you sell a t-shirt for 20 euros, your selling price is 20 euros.

What are variable costs?

These are costs that vary depending on how many products you sell. For example, if you sell t-shirts, variable costs can be the purchase price of one t-shirt, printing costs, postage costs, as well as any discounts and advertising costs.

If you sell more shirts, those costs go up – they change. You know their amount at the moment of sale (you don’t have to wait until the end of the month).

What are fixed costs?

These are costs that remain the same no matter how many products you sell. These can be costs for renting a warehouse, handling internet payments or online store hosting fees.

The result is a cover charge

Once you deduct the variable costs from the selling price, you are left with the so-called cover charge. This is what you need to cover your fixed costs and make a profit.

“The advantage of running a company on cover charges is that you can calculate them on practically any date of the month, because you know both the variable costs and the selling price.”

Knowing your cover charge will determine how many products you need to sell in order to cover your fixed costs and start making money. At the same time, it enables you to plan better and manage your online store in order to be successful and profitable.

Practical use of cover charges

We calculated cover charges for a client that sells tires.

The results:

- Based on the cover charges, we found out which brands contributed the most to their fixed costs and which the least.

- We divided all contributions into 100% and the client was immediately able to see which brands contributed 20% to the cost and which covered only 2%.

- We even found brands that didn’t contribute at all, and instead ate up their cover charge. That meant that even if the client sold these products, not only did they not make a profit, but they made him lose money.

We solved the problem individually with the client, but in general, the fact is that in such cases, you either have a poorly set selling price, your discounts are too heavy, or you spend too much on marketing.

A truth you cannot hide from

The beauty of cover charges is that they do a good job of separating big turnover from the work you put in to them in the first place (margin cutting, advertising, free shipping, etc.) and thus showing the true value of the product or brand.

Many online stores sell brands or products in bulk, but their real benefit is nowhere near what the turnover suggests. They work hard with the product (lots of packaging, processing returns), but it has little effect on fixed costs.

“There is no rational reason to sell brands that you have to subsidise in the long term. You should also eliminate those products that have a very small contribution and the chance of their repeated purchase in the foreseeable future (1-2 months) is low.”

A more sophisticated approach

If you use cover charges, you can leverage them in an even more purposeful way. Not every order has the same cover charge. Sometimes you have to put more into marketing, other times sales happen by themselves.

However, you can find out what percentage of cover charges from a given brand are negative.

- For example, some brands may have a 2.5% negative charge. That’s not bad.

- Another brand may have a 20% negative charge. Every fifth sale from this brand is negative and you have to subsidise it before it can even contribute anything to cover fixed costs.

Which online stores will benefit the most?

Cover charges will improve almost any online store, but the best results will be achieved by online stores that have already managed to grow a little bit and sell a variety of goods. In general, the more product types, suppliers and margins you have, the more useful outcomes you will get.

Streamlining the business = lower turnover

If, based on the analysis, you eliminate some brands and remove the products that eat into the cover charges, you will increase your profit. However, expect turnover to decrease.

Optimisation results in a decrease in sales. But, on the flipside, you will earn efficiently. Profits will increase, sales will decrease.

Want more money for less work?

Hundreds of online stores have already passed through our financial analyses, including companies with sales figures ranging from 1 to 250 million euros per year. We know that every half percent counts and the only thing that matters at the end of the month/year is profit.

If you feel that your profit is small and could be bigger, you are probably not wrong. Get in touch and we’ll help you uncover the issues that are holding back your profitability.